-

Nasdaq Announces Mid-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date July 15, 2024

ソース: Nasdaq GlobeNewswire / 24 7 2024 15:05:00 America/Chicago

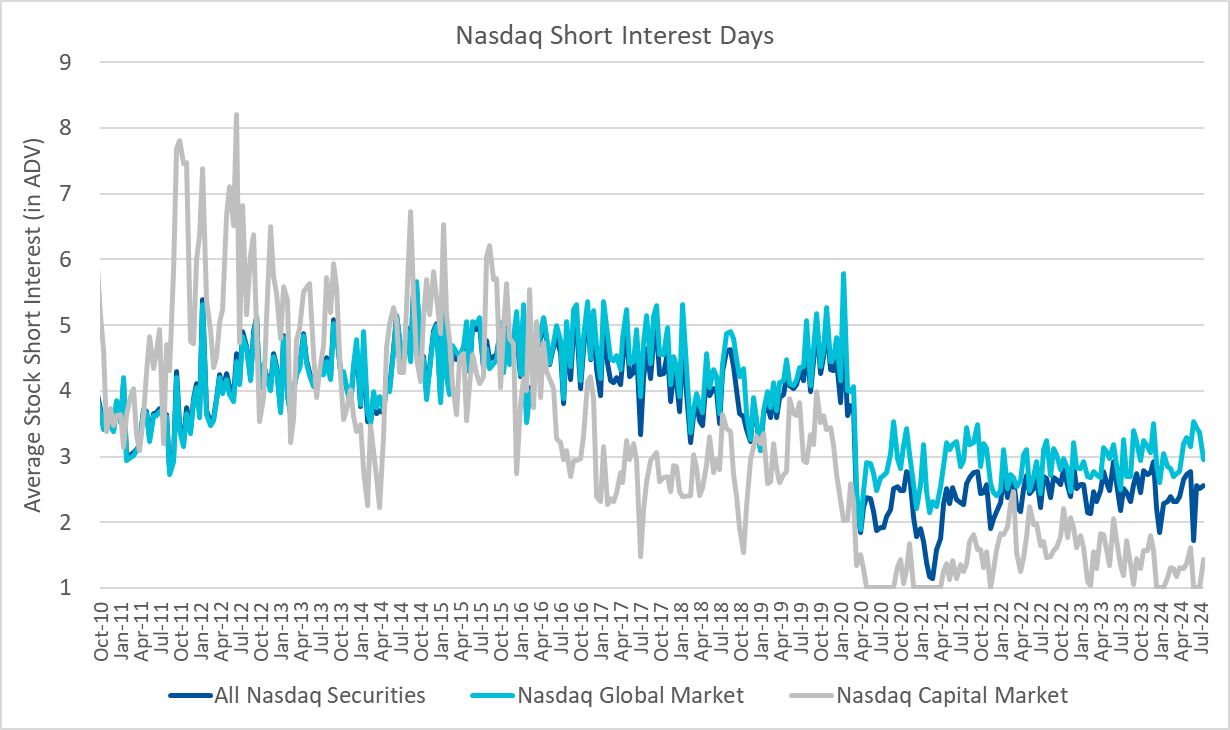

NEW YORK, July 24, 2024 (GLOBE NEWSWIRE) -- At the end of the settlement date of July 15, 2024, short interest in 3,044 Nasdaq Global MarketSM securities totaled 12,309,469,231 shares compared with 12,156,830,526 shares in 3,052 Global Market issues reported for the prior settlement date of June 28, 2024. The mid-July short interest represents 2.95 days compared with 3.37 days for the prior reporting period.

Short interest in 1,687 securities on The Nasdaq Capital MarketSM totaled 2,046,452,681 shares at the end of the settlement date of July 15, 2024, compared with 2,040,351,094 shares in 1,685 securities for the previous reporting period. This represents a 1.43 day average daily volume; the previous reporting period’s figure was 1.00.

In summary, short interest in all 4,731 Nasdaq® securities totaled 14,355,921,912 shares at the July 15, 2024 settlement date, compared with 4,737 issues and 14,197,181,620 shares at the end of the previous reporting period. This is 2.56 days average daily volume, compared with an average of 2.51 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit

http://www.nasdaq.com/quotes/short-interest.aspx

or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.NDAQO

Media Contact:

Jennifer Lawson

jennifer.lawson@nasdaq.comA photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b636b834-e59e-4a7c-8f37-934e4974c0c5